A Nudge and A Wink – The Essence of Customer Value Management

For many years now, Andrew Ehrenberg, Professor of Marketing at London’s South Bank University, has been urging marketers to forget loyalty and embrace “nudging”. His reasoning was that big brands are big because they are bought by more people, whether they are loyal or not. Concentrating on loyalty alone misses the point. Better he says, to concentrate on “nudging”, gently but continually reminding the consumer that you are there, you are relevant and you can provide the satisfaction they want.

Yet the best customers, we are told, are the loyal ones. They cost less to serve, they are less price sensitive, they act as brand advocates and, thereby, they make us more money. Concentrate on building a relationship with the customer, make them more loyal, profits will rise and you’ll never look back. But is it really that simple?

A study published in the HBR in July 2002 sought some evidence to support these claims. Unfortunately they couldn’t find very much. Reinartz and Kumar, in a paper prepared jointly by INSEAD and the University of Connecticut, studied the customer databases of a US high-tech corporate services provider, a French food retailer, a large US mail-order company and German direct brokerage house to see if there was any relationship between loyalty, revenue and profitability at the customer level. Their conclusion was that if there is a relationship then it is much weaker – and much subtler – than proponents of CRM would claim.

So is loyalty a worthy objective for marketers or is it just a “leger de main”?

Reinartz and Kumar concluded that “Instead of focussing on loyalty alone, companies need to find ways to measure the relationship between loyalty and profitability so that they can identify which customers to focus on and which to ignore.” Companies only need to know… just when to let go of a given customer in order to dramatically improve the returns on their investment in customer loyalty management.”

In order to do this companies need to classify customers not only in terms of their past loyalty but also in terms of their likely future value. Fortunately RedRoute’s new CVM service addresses this need. Launched originally in February 2000, it aims to help companies understand the drivers of potential future customer loyalty and customer value so that they can direct their marketing funds, and customer relationship management programmes, at those customers who are likely to provide a payback.

RedRoute do this by bringing together market research with customer database information to provide models that companies can project across their entire customer base and step-change the return on their one-to-one marketing programmes.

RedRoute’s approach to this, and the CVM service used to deliver it, are outlined in the rest of the article below and we believe this will be the basis on which all companies investing in CRM will come to manage their programmes in the next few years.

1. Company Marketing Objectives

The primary objective of the marketing department in most commercial companies is (or should be) to satisfy consumer needs better than the competition and help the business as a whole provide a satisfactory return on investment for its shareholders.

The result should be to maximise sales and market share at an acceptable level of profit. The challenge of customer-specific marketing is how far can we flex the offer to maximise the number of customers we can satisfy, and market share we can achieve, but still make an acceptable level of profit. In terms of fundamental economics, the principle of effective customer value management is to maximise our share of each and every customer’s level of demand at their marginal price provided that price is at least equal to our marginal cost. This is shown in the diagrams below :

Unlike traditional marketing, where the “maximum” price is set by the market (left hand diagram), in the CVM world (right hand diagram) we seek to establish the highest mix of price and service that each individual customer is willing to pay by knowing more about individual customer needs than was ever previously possible.

In the traditional world consumers gain a “surplus” which is the difference between the price they actually paid (P1) and the price they would have paid (given by the demand curve). Others who wanted the product but were unwilling to pay P1 either bought elsewhere or went without. For the company, share can only be expanded either by creating greater demand or by cutting the price.

In the CVM world each customer can, in principle, be charged a different price, PC(1) for customer 1 to PC(n) for customer n. This transfers the consumer surplus to the company who give it back in the form of a more tailored offering.

This is the basis of sound customer value management. So why, then, have so many companies been getting it wrong and finding that CRM offers no return? In many respects it is because they are using the technology incorrectly as shown below.

Why Companies Fail at CRM

The problem many companies have faced is that those selling CRM are technologists. To them, marketing is about driving short term sales from targeted offers – i.e. price reductions or other give-aways. Unfortunately this produces the opposite effect to the one intended. As the two diagrams below explain, gathering the data means we first put cost into the business. If all we then do is use it to boost demand by cutting prices (and then only to customers who already use us) we are reducing our price below the existing market price P(0). Whilst this may result in extra short term revenue, all of it is at less than the “cost to serve” and therefore unprofitable. Meanwhile, we provide nothing extra to the customer that makes them inherently more loyal and at best we attract even less loyal and more price sensitive customers than we started with.

Correcting the Problem

As the left hand diagram shows, by engaging in CRM our costs move from CTS(0) to CTS(1) and we should aim to increase price, customer-by-customer, to between PMin (1) and PMax (1) to generate a return on this investment. Equally, we must seek to lose all those customers who will only buy from us if the price is less than PMin (1) i.e. the customers who we believe will be unprofitable. Demand moves from D(0) to D(1).

Clearly the problem with this model is that it results in a lower average market share and customers are no more loyal than they were previously. We therefore need to give back some of the additional profit to the consumer in ways that are valuable to them but are cost-effective for us to provide. The diagram on the right shows that our objective must be to increase demand at any given price, aiming ideally to take additional market share compared to what would have been achieved otherwise.

To make this work , however, requires uncovering how we can use the technology to serve the customer better than the competition which is why mixing market research with customer-specific transactional data is the right way to proceed.

2. The Essence of Customer Value Management

The essence of Customer Value Management is not, therefore, in knowing how valuable and how loyal customers already are but in knowing how valuable and how loyal they could be. To determine this, clearly a good place to start is to know not only their current value and current loyalty but also their current satisfaction as this will be a key indicator of their likelihood to continue to use our product or service.

However, this is not the only information we need to estimate future customer value. We also need to know about the customer’s circumstances and how likely they are to change in the months ahead. We need to know how they might respond to any new or improved proposition we or our competitors might make to them, and we need to know their inherent attitudes towards the product or service itself, towards ourselves, our competitors, and life in general. In fact, our ability to find and use this additional information well is the only thing we can do that enables us to differentiate ourselves from our competitors. Everything else our competitors can either copy or buy-into.

The RedRoute CVM service recognises this and is designed to help companies fully integrate data from their existing customer satisfaction surveys into their database CRM strategies in a manner which guarantees the attainment of identifiable and substantial profit increases. This is achieved by using tailored survey research alongside existing data sources, first, to identify exactly what we need to know about each customer to better satisfy their needs and, second, who it is worth doing it for.

The end result should be more satisfied, more loyal and more valuable customers.

And a positive, as opposed to negative, return on your investment in CRM.

From CSM to CVM

We are often asked by companies how they can better understand who their most loyal customers are and which customers they should target to prevent defections and generate win-backs. These companies typically have an existing Customer Satisfaction Measurement (CSM) programme in place and have a customer database which they already use for direct marketing and / or customer relationship management.

Survey research can clearly be used to quantify groups of customers into segments like those shown below, as is provided, for example, by the Ipsos Loyalty-Builder service:

The problem clients experience with this, however, is that models built on survey research alone cannot be reliably projected across the database at the level of each individual customer. The information collected is representative of those who took part in the sample but the same depth of information does not exist about those who did not take part in the survey. To project across all customers, compromises have to be made, by using surrogate variables for example, which typically results in attribution rates of the order of 30% – 40% at best. This makes it difficult for clients to “find” the right people on their database and undermines their confidence in using the models.

In addition, they are often sceptical about targeting their customers on the basis of models that are based primarily on attributes that are imputed from a model instead of being collected directly and unambiguously from the specific customer concerned.

Whilst these concerns persist, any customer satisfaction survey information collected by a professional market research organisation which cannot then be flagged against individual customers for use in targeting (i.e. the norm for most research organisations) will be confined to providing generic advice on service delivery.

The RedRoute service addresses this problem by approaching it from the opposite direction. We begin with the client’s customer database and look to establish how it can be extended using, for example, survey research on current customer satisfaction, in order to better predict the future level of customer spend, customer loyalty and, ultimately, customer profitability. The outputs from models such as those provided above by the Ipsos Loyalty-Builder product, thus become contributory inputs into more general models which have much higher inherent usability for the client.

The remaining sections below outline how this is achieved.

3. The RedRoute CVM Service

The RedRoute service has 3 key steps to gaining additional loyalty, sales and profit:

– Predicting the Gain

– Validating the Gain

– Delivering the Gain

To predict the gain we first understand and model the key drivers of customer loyalty and then use the model to predict the potential gain from an improved (more optimal) allocation of the CRM marketing budget, focusing resources into attracting and retaining customers who are likely to provide a positive return on investment.

To validate the gain we design in-market tests which enable you to prove the benefits of using the new strategy before you need to commit to it fully. This enables you to prove the logic of the strategy to the business as whole and gain internal commitment.

Finally we help you implement the on-going process of routinely combining the learnings from your satisfaction research with your database both to achieve and maintain the gains that the Customer Value Management strategy will deliver.

Predicting the Gain

To predict the potential gain from adopting a Customer Value Management strategy we first need to understand and model the processes that are driving on-going customer purchase decisions. We can then look forward to see how those factors may be changing and see the extent to which we can “nudge” customers in our direction.

We can then place a value on the likely returns and prioritise customers accordingly.

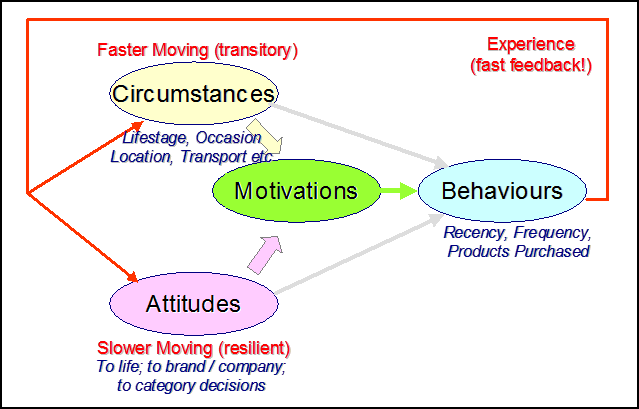

The diagram below presents this predictive model. This shows that we bring together information on each customer’s circumstances, attitudes and behaviours and then, by using data mining techniques, understand behaviours in terms of the underlying customer motivations that are driving them.

This process enables to understand the ways in which these factors interact and their relative weightings in driving the behaviour of each individual customer. We can then identify which customers – and which prospective customers – can be “nudged” (and in what ways) towards using our service or product.

For example, if we were a retailer, then even if we knew Mrs Jones was well-disposed towards our company, found our service highly satisfactory and knew we could meet her requirements she may still not use our service as much as we would like because she is too far from the store. Using the model, we are able to make a judgement as to whether the cost to us of helping her to overcome the distance to store barrier (for example, by providing free delivery) would lead to sufficient extra business to make it worthwhile. We can do this because the model places the distance-to-store factor alongside all other factors such that we can see how much her behaviour would change if we eliminated that obstacle. We can then add up the likely responses across all such customers to see if setting-up a new delivery service would payback.

Naturally our competitors could do similar analyses. Our main weapon, therefore, is to make sure that we use the model to leverage the database investment we have made firstly to provide all of our customers with the means to select the type of service that is best suited to their needs, and secondly to guide us on who to tell about it (both existing and potential customers) and the likely level of payback we would get from it.

Creating the Predictive Model

As mentioned above, the predictive model brings together information on each customer’s circumstances, attitudes and behaviours and there are three components to the modelling, the survey research, the database, and the integration of each of these into a single motivational model as outlined above.

If the client’s customer database is in any way transactional (i.e. it records the products or services purchased, prices paid, contacts they have made with us and so forth) then the behavioural data is taken directly from the customer database. If the customer database is purely names and addresses then the behavioural data is collected via the survey research and used as the best approximation.

Measures of behaviour are typically items such as level of spend, frequency, average transactional size, recency and so forth. Customers can then be grouped (segmented) into differing types of behaviours using these measures so that the determinants of the patterns of spending within and between groups can be explored. The inclusion within the behaviour measures of aspects such as the extent to which they use the call centre is also useful as they may impact upon the customer’s profitability. They can also help us to understand and model the relationships between attitudes, circumstances and behaviours. For example, high usage of the Help Desk service may be related to the type of equipment that the customer has or be related to their personal characteristics. Either way, this may be duplicated across other customers and so we may need to incorporate this into our estimate of the future profitability of such customers.

Data on customer circumstances typically comes from both the customer database and, for a sample of customers, from the survey research. It may be necessary to conduct a specific piece of additional research with customers to provide the full and in-depth customer profiles needed for the modelling. If so, these are undertaken via a specific Usage & Attitude Study commissioned for the purpose. One key measure that the research data provides is the customer’s total spend in the marketplace. From this we are able to estimate our “share of wallet” and, in conjunction with the other data we have, use the data modelling (see Section 3) to project this across the database.

Attitudinal data, including the customer’s current level of satisfaction with the product or service being provided, is also derived from the (available) survey research and the research data modelled to understand the differing attitudinal segments that exist within the market, whether and how these differ for customers of the particular client concerned, and their current level of commitment to the product or service provided.

The modelling of the survey research therefore also results in a series of “measures” about the customer. These include aspects such as how concerned they are in the choice of whether and which company to use, their views about the relative worth or credibility of differing offers and suppliers, how likely they would be to switch supplier, whether particular aspects such as having a loyalty scheme is important to them, and their views on which aspects they would value most highly or feel should be taken as givens such as speed & convenience. Typically they would also include some measure(s) of current attitudinal loyalty and / or current satisfaction since these may be predictive of future behaviour when viewed along with all the other factors.

Gathering the information as outlined above therefore provides us with a dataset that we can use to model the relative impact of differing attitudes and circumstances upon behaviour. Moreover, by starting with all customers we are able to build a general model that the client can apply across their customer base and can extrapolate outside it to potential new recruits. Alternatively we can use sub-sets of customers specifically selected to enable the impact and contribution of individual aspects such as customer satisfaction to be identified separately from other factors. This may not provide such a general tool but may be appropriate in situations where the results can be readily overlaid onto the client’s existing customer value management operations.

The nature of the dataset is shown in the diagram below. Essentially we take a cross-sectional “slice” of the market with varying levels of information about each customer.

Modern data mining techniques, such as those provided by the SAS software system, enable us to model this data even though we have varying depths of information about different customers. Naturally it is important to provide as big a market research sample as possible so as be as representative of the market as possible. For mass market products, such as the national UK DIY retailer shown above, the market research sample should ideally be of the order of 3000 consumers but the “right” number will clearly depend upon the market being analysed. This is one reason why a market research company is optimally placed to carry-out such analyses for clients.

The modelling provides an “equation” which links together the key driving factors that determine the customer’s probability of behaving in differing ways at differing times. This enables the client to understand why each customer might choose company X to satisfy need Y in circumstance Z.

In a retail environment, a typical model might contain the following factors :

S(i,t) = f (DTS * ATC * ATB * CSI * L * SC * DI * PC * AM) * S(i, t-1)

where S(i,t) are the sales obtained from customer (i) in time period (t), DTS is distance to store, ATC is Attitude to the Category, ATB is attitude to the Retail Brand, CSI is their current level of satisfaction with the brand, L is their lifestage and / or lifestyle, SC is their social class, DI their disposable income, PC is a set of factors relating to the other personal circumstances and AM represents the set of advertising messages that they have received. An example, taken from a public presentation made jointly with one of our clients in September 2002 is shown below and highlights the positive and negative influences of differing factors on probable future customer behaviour.

The resulting models are usually highly reliable with the ability to correctly predict individual customer spend behaviour with an average of 70% – 80% accuracy. This gives the client a high level of confidence in using the models for decision-making.

They also provide additional and valuable benefits as highlighted on the diagram which shows that by using this approach the influence on individual customer behaviour of factors such as TV advertising can be evaluated in addition to customer-specific marketing activities. This makes it a very valuable marketing tool.

Using the Model to Predict the Potential Gain

Once the modelling is complete we can combine the knowledge from the model with marketing cost information and by aggregating all the potential responses across customers and customer segments we can establish more optimal marketing budget allocations using to gain either more sales, profit or both as described in Section 1.

Scenarios help management decide how the customer marketing budget should be allocated across the customer base and which particular communications and/or propositions would be likely to be most effective in each case. For example, a customer may be very active in the marketplace but spending relatively little with us. This could be for a simple reason that we can help alleviate – like the “distance to store” problem faced by Mrs Jones earlier. On the other hand it could be that owing to a previous bad experience the customer has very low satisfaction with our company’s offer and no matter how many times we may contact them, and in whatever way, we will be unable to overcome that particular negative influence – it is just too strong.

By contrast others may be active in the market and their profile may suggest they should be spending more with us than they currently are. These people could then be contacted whilst the former group are ignored. Marketing spend is unchanged but the potential sales from that marketing spend will rise as the second group probably have a much higher likelihood of responding to our advances.

As the diagram below indicates, the model enables us to look at three dimensions, what they currently are spending with us, how profitable they are, and what (given their circumstances) they are likely to spend in the future (under differing scenarios). We can then make sure that we respond to the needs of those who will be most active in the market and most profitable for us whilst identifying and ignoring those who are likely to be least attractive or, worse, cost us money to service or supply them.

Validating the Gain

Unfortunately being able to model to past is no guarantee of divinity. The model is, by its nature, based on data that has already been collected and is therefore in many respects retrospective. To predict well we are reliant on this data being fully representative of the customers in the market but inevitably this may not be the case.

For example, the quantity and quality of data available may have been less than ideal and both breadth and depth may have been compromised. This means the models will be inherently less reliable or, at least, less generalisable, than we would like. Naturally the way to answer this is to conduct tests whereby differing customer segments are managed in differing ways over the course of one year.

It is important, though, to ensure these tests are statistically designed before they are run so that by the end of the tests the results are unambiguous. The “Test & Learn” process used by the direct marketing industry is designed to test response to individual mailers. It is conducted like a fly-fishing exercise in which the only guarantee one has up-front is that the client knows there are some fish in this particular lake. However, they have no idea what bait to use, where to cast or how big the catch will be.

The RedRoute-CVM approach, by contrast, sets out to explicitly design tests which we know up-front will be measurable and provide robust validation of the potential gains. They are designed using the same statistical principles used in clinical trials. This is summarised in the two diagrams below:

By analysing the variances in historical purchasing patterns we were able to calculate how big the sales uplifts need to be in order for them to be identified with 95% confidence amongst differing customer segments. This is important because customer purchasing patterns vary widely depending on their circumstances and we wish to ensure that the results are visible almost from the raw data.

By taking assumptions as to the feasible levels of sales uplifts we might expect to achieve we could then determine the minimum lengths of time and minimum numbers of customers we need for running the tests. This helps to set both management expectations and an action standard for use in judging the results.

Delivering the Gain

Once the testing process has confirmed that the model we have used provides reliable guidance for optimising the allocation of the CRM marketing budget then the process of managing customer value can be made more routine.

Typically this is achieved by supporting the client in three key areas:

– measuring the value of (proposed) improvements in service delivery

– providing continuous customer satisfaction and other survey data

– predicting retention rates at aggregated & customer segment levels

In the first area we model the data from continuous customer satisfaction tracking to understand how individual aspects of service delivery contribute to overall satisfaction. The CVM modelling already links overall satisfaction to sales and profit performance. By putting these two sets of information together the value to the business of potential service improvements are evaluated and prioritised. Furthermore, we are also able to demonstrate the value delivered by previous service improvement initiatives. One example of this, for a retail supermarket, is shown in the diagram below.

In the second area, the motivational models are adapted for the client (either for use internally or with RedRoute support) to “score” every customer on the database so that they can be assigned a priority or other classification for attention. These scores are then (automatically) updated regularly using the latest customer satisfaction and other relevant tracking information collected continuously by RedRoute and / or the client.

In the final area we then use the sores to provide regular reports on future customer loyalty and customer value both in aggregate and at segment level to enable the client to manage the business by looking forward rather than backward.

Conclusion

Maximising customer loyalty is worthy objective for marketing managers but when it is being sought through the use of CRM systems clients must use the information these systems provide to enable the customer to obtain a more tailored and higher value-added product or service than they can obtain from the competition. This will enable the client to achieve a more loyal customer base and obtain the profit rewards promised by the technologists. Using CRM just to give away “offers” is not the answer.

The RedRoute-CVM service helps clients achieve these objectives and creates greater marketplace success. It does this by enabling customers in the market to be divided into those whom we wish to acquire, retain and develop and, just as importantly, those whom we wish to ignore as they are unlikely to provide an adequate ROI.

It then further enables us to know exactly which customers can be “nudged” more favourably in our direction either by offering a slightly different service proposition or by being kept informed about promotions and opportunities relevant to them. This is backed-up by knowledge of the full profit implications of any actions we may take thereby ensuring that we get the best return from the CRM marketing budget and obtain the oft promised but seldom delivered “loyalty bonus” from the CRM system.